Crude Oil Futures: Further weakness in store

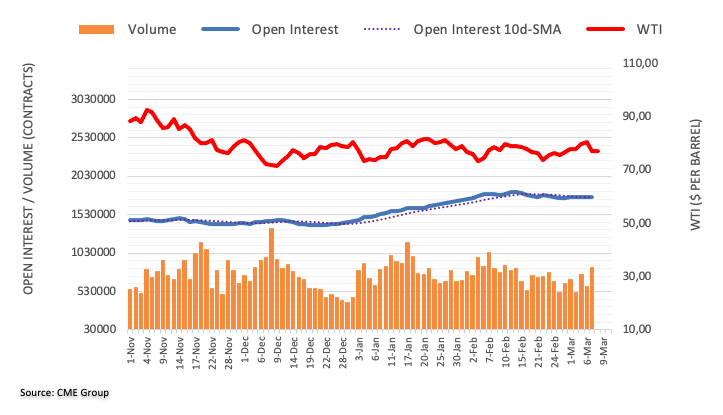

Open interest in crude oil futures markets increased by around 2.1K contracts on Tuesday, extending at the same time the erratic performance according to preliminary readings from CME Group. In the same line, volume maintained the choppiness well in place and rose by nearly 260K contracts, offsetting the previous daily drop.

WTI: Another drop to the $72.00 region should not be ruled out

Prices of the barrel of the WTI dropped markedly on Tuesday amidst increasing open interest and volume, suggesting that extra decline appears on the cards in the very near term. That said, a probable retracement to the area of 2023 lows near $72.00 remains on the table for the time being.