USD/JPY bulls eye a break of key daily resistance with US CPI eyed

- USD/JPY traders await the US CPI data for the next major scheduled catalyst.

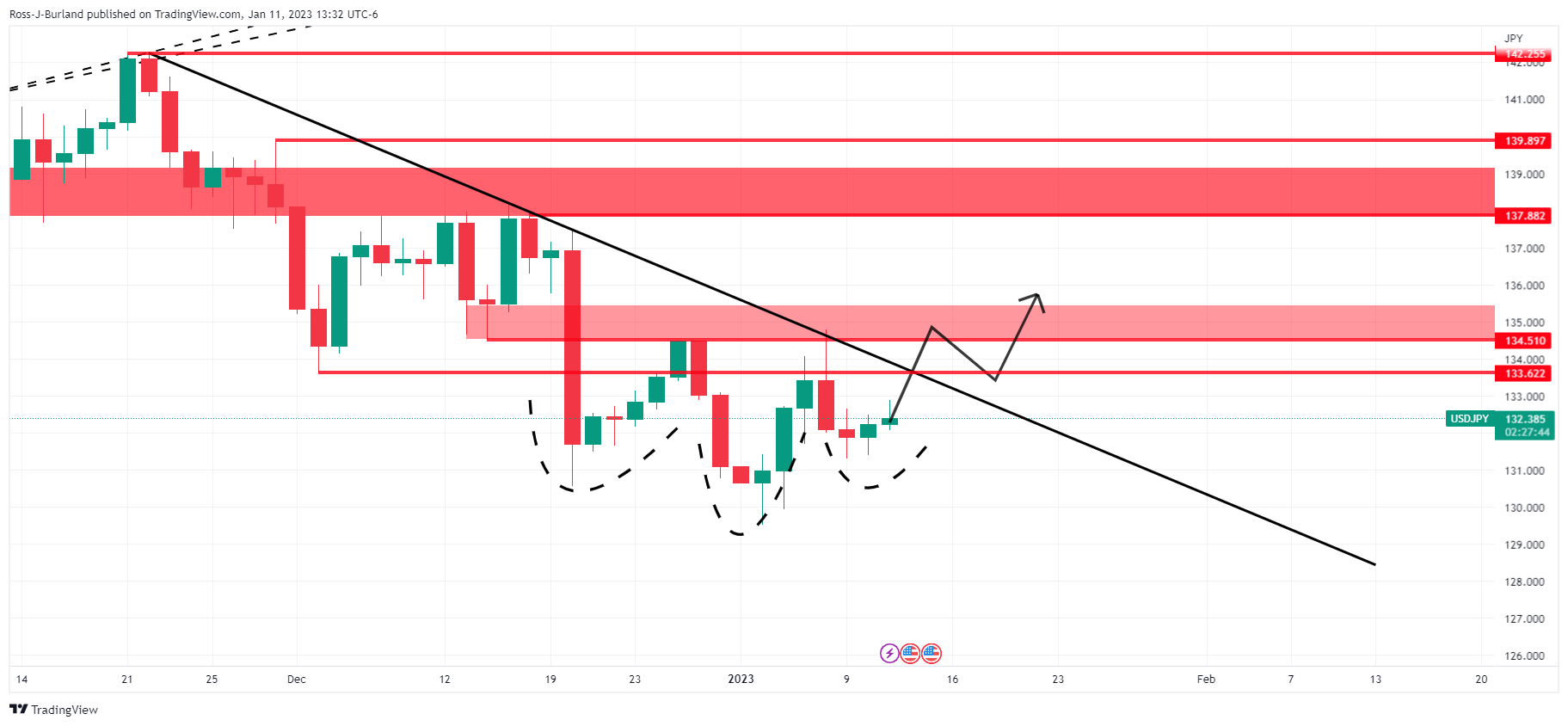

- The price is coiled and an inverse daily head and shoulders could be in the making.

USD/JPY is attempting to move higher during a light schedule in the North American session but has run into offers as US stocks climb to fresh highs for the week. at the time of writing, USD/JPY is trading back to flat for the day at 132.35 but has travelled between a low of 132.06 and 132.87 the high for Tuesday and the week so far.

Wall Street's main indexes are bid as investors keenly await the US consumer price index which seems to have weighed on the US Dollar and US Treasury yields in the recent hours of the session. The 10-year yield is now down by 1.66% and meeting an hourly support structure near 3.563%. If this were to hold, this would offer the greenback some support also and fend off the USD/JPY bears leaving the cross to tread water into the CPI data on Thursday where traders expect to get more clarity on the Federal Reserve's rate hike trajectory.

In this regard, analysts at TD Securities explained that they are looking for core prices to have edged higher on a monthly basis in December, ''closing out the year on a relatively stronger footing,'' they said.

''Indeed, we forecast a firm 0.3% MoM increase, as services inflation likely gained momentum. In terms of the headline, we expect CPI inflation to register a slight decline on an unrounded basis in December, but rounded up to flat MoM, as energy prices offered large relief again. Our MoM projections imply that headline and core CPI inflation likely lost speed on a YoY basis in December.''

As for the US Dollar, the analysts said ''Unless the core measure significantly surprises to the upside, USD rallies should be sold into. We think the bar is high to compel a reversal of fortune despite the USD tactically stretched.''

USD/JPY technical analysis

As per the prior analysis, USD/JPY Price Analysis: Consolidation into US CPI, bulls on the prowl, the price is coiled and an inverse daily head and shoulders could be in the making:

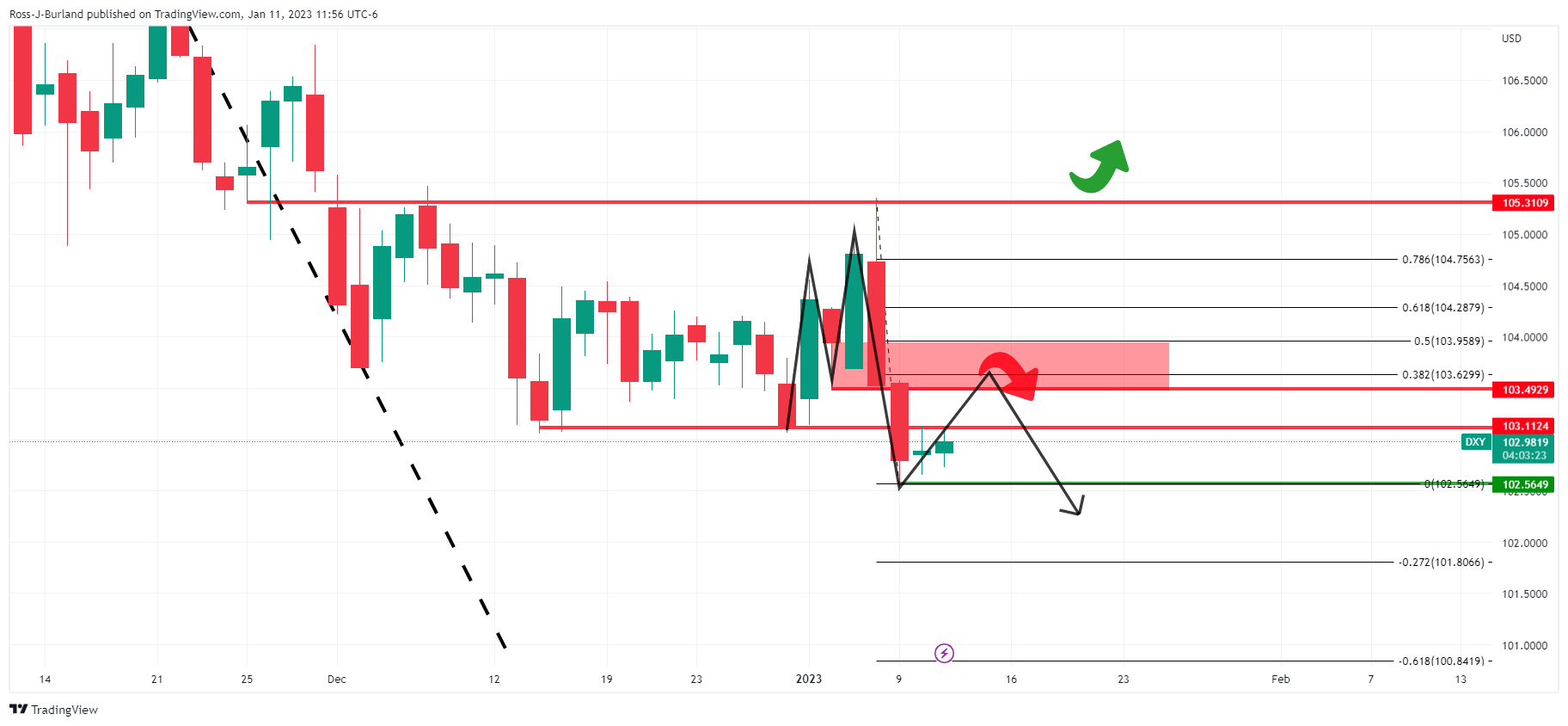

Such an outcome would take out the daily resistance and tie in with the bullish outlook for DXY as follows, where an M-formation is in play:

The M-formation is a reversion pattern and the price would be expected to move in for the restest of the resistance structures and neckline of the pattern between 103.50 and 104.00. Such a move would align with a 38.2% Fibonacci retracement and a 50% mean reversion at the extreme.