Back

11 Jan 2023

Crude Oil Futures: Further consolidation likely

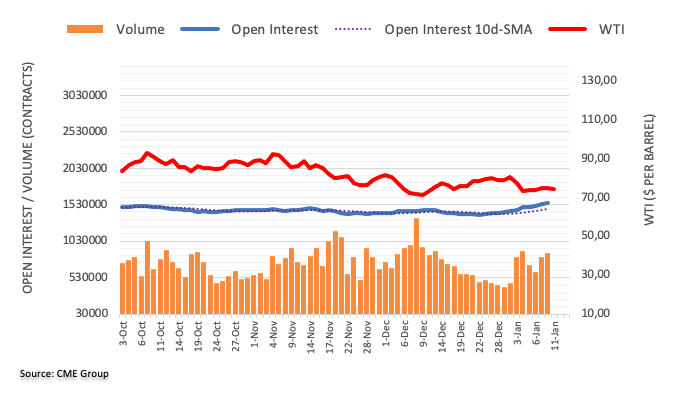

Advanced prints from CME Group for crude oil futures markets noted traders added around 23.4K contracts to their open interest positions on Tuesday, keeping the uptrend well in place since December 23. Volume followed suit and rose for the second consecutive session, this time by around 46.3K contracts.

WTI appears supported around $72.50

Tuesday’s small downtick in prices of the barrel of the WTI was amidst rising open interest and volume. That said, the current range bound theme in the commodity is therefore expected to persist at least in the very near term, with the initial contention around $72.50 and the immediate target at the so far weekly high at $76.70.