Back

11 Jan 2023

Gold Futures: Still room for further upside

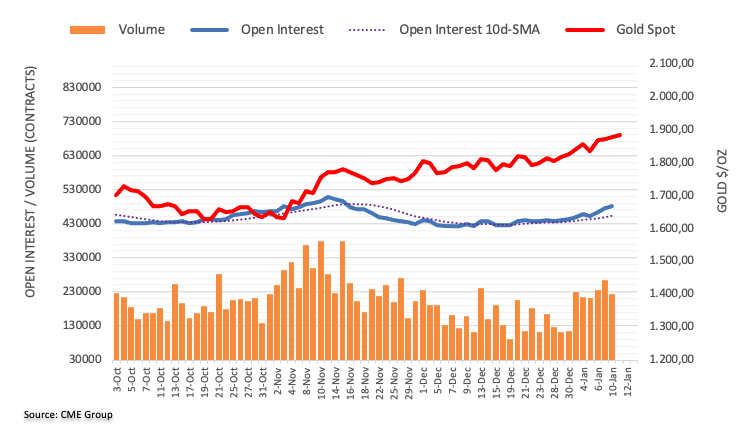

Open interest in gold futures markets increased for the third session in a row on Tuesday, this time by around 5.7K contracts according to preliminary readings from CME Group. Volume, instead, reversed two consecutive daily builds and dropped by nearly 41K contracts.

Gold: Next on the upside comes the $2000 mark

Gold prices extended the uptrend in the first half of the week and flirted with the $1880 region on Tuesday. The uptick was on the back of rising open interest, which is supportive of the continuation of the move in the very near term and continues to target the $2000 mark per ounce troy.