Our best spreads and conditions

About platform

About platform

AUD/USD is offered due to record COVID cases in China and citizens protesting against the country's zero-COVID rules have increased safe-haven flows to the U.S. dollar.

Moreover, investors have flipped their net long US Dollar positions, anticipating weakness on the back of expectations that the Federal Reserve will slow the pace of interest rate increases. This leaves more room for paring back of recent speculative short positions in the greenback and that leaves the downside vulnerable in AUD/USD as follows:

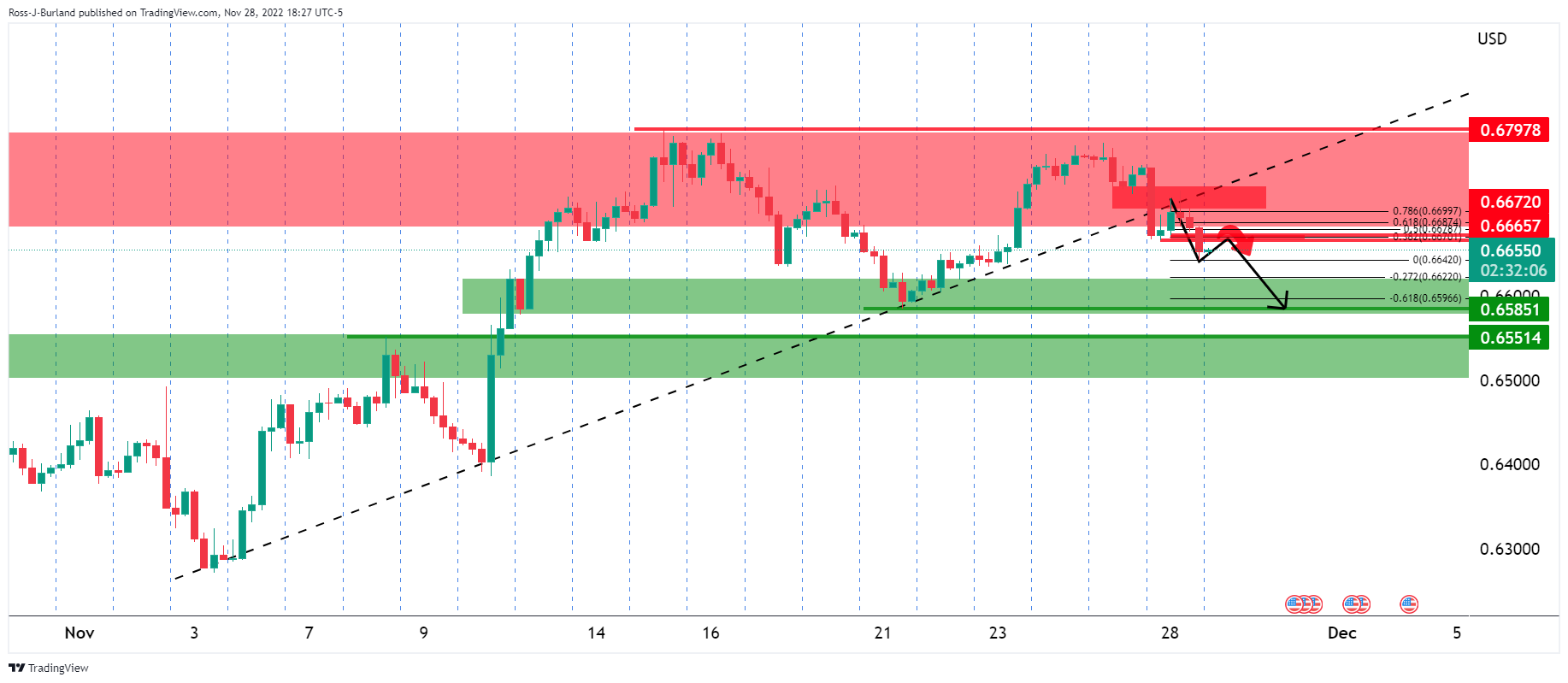

The double top on the daily chart has led to a break of trendline support which is a bearish development for the week ahead. 0.6600 is vulnerable for the coming forex sessions.

In the 4-hour time frame, the price is moving in a series of bearish impulses:

The price is moving up in Asia but the bears penetrate below 0.6650 at the start of this week and cleared out some of the weaker hands. Therefore, should resistance hold at prior support near 0.6700, then there will be prospects of yet another bearish impulse for the sessions ahead. The 0.6580s guard 0.6550 and then 0.6500.