Eyes on RBNZ that is set to deliver biggest rate hike ever, Kiwi bid

Reuters reports that New Zealand's central bank is expected to deliver its biggest-ever rate point hike this week as it continues efforts to temper inflation ahead of a three-month break.

Key notes

A front-runner in withdrawing pandemic-era stimulus among its peers, the RBNZ has remained singularly focused on curbing inflation, lifting rates by 325 basis points since October.

A Reuters poll found 15 of 23 economists expect the central bank to lift the cash rate by a record 75 basis points. The remainder expect it to raise rates by 50 basis points. The market is similarly divided.

New Zealand-based economists are more hawkish than their international counterparts, unanimously expecting the central bank to hike by 75 basis points.

Craig Ebert, senior economist at Bank of New Zealand, said locals might think this is because those abroad don't appreciate quite the extent of core inflation pressure playing out in New Zealand.

"While that may be a fair call, it's also worth noting the views of overseas commentators will be influenced by what they are seeing around them, which likely speaks to some of the global risks facing New Zealand," he said.

The central bank will also release new economic forecasts and potentially an updated cash rate track.

"It all comes down to the language around the OCR (official cash rate) track and its shape," said Kiwibank in a note. "Market traders have the peak in the OCR in May next year. We agree. From there, thoughts of rate cuts grow."

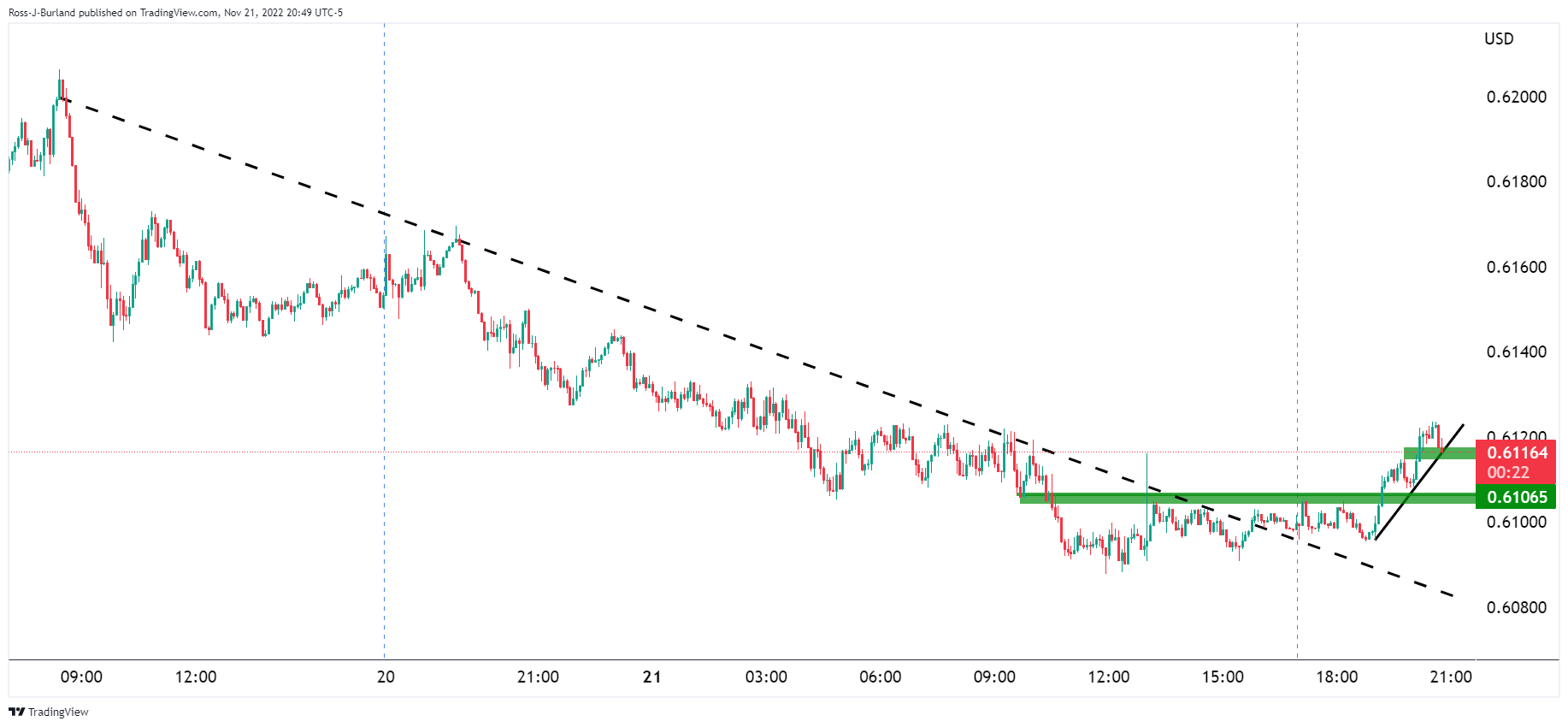

NZD/USD cracks trendline resistance

Markets are risk-on which is supporting a recovery in the high beta currencies such as NZD/USD.