WTI Price Analysis: Range bound but a break out could be immanant

- Oil bulls seek a break of $80.40/50 for the day ahead.

- If bears take control, however, then $76.00 could be vulnerable if $78.50 gives as the 38.2% ratio support.

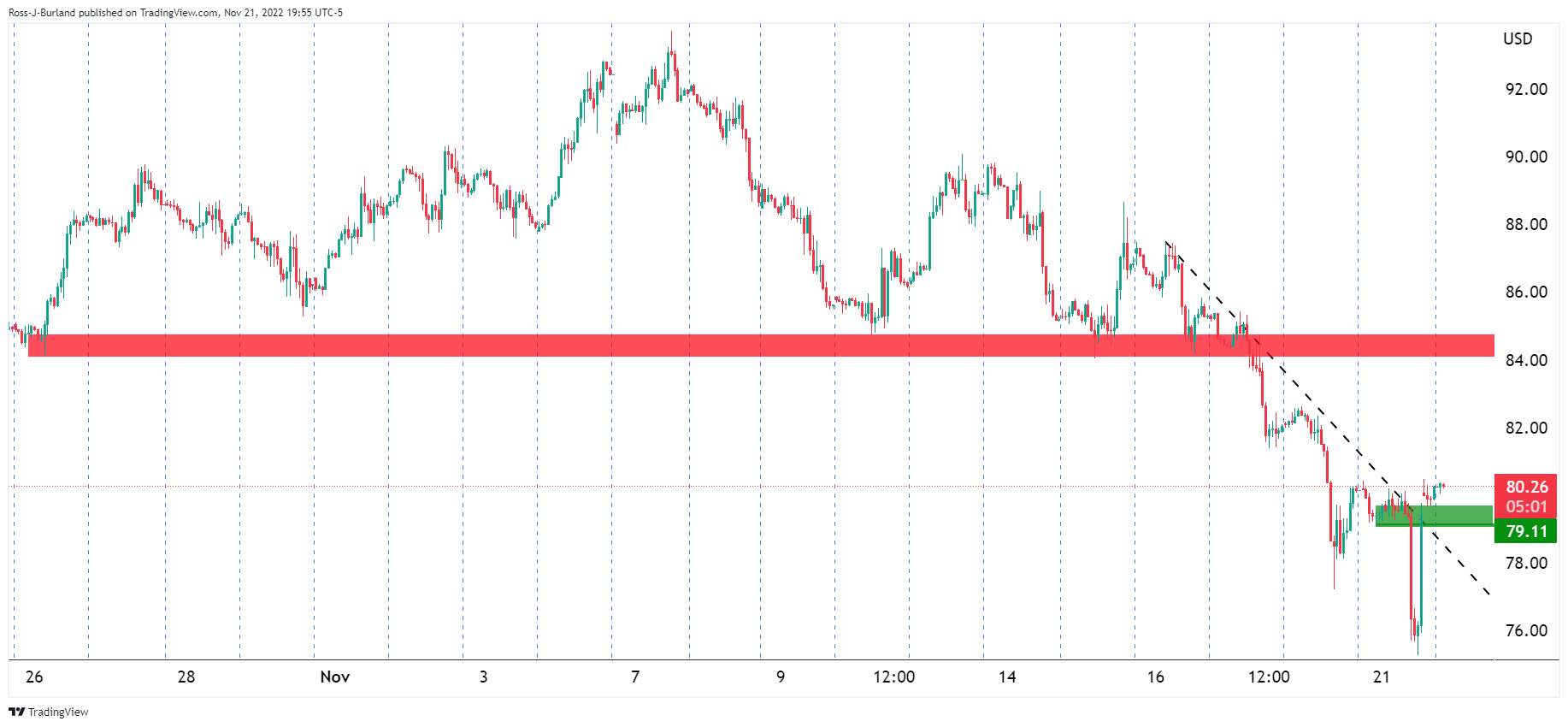

West Texas Intermediate, WTI, crude oil fell for a fourth-straight session on Monday as China wrestles with rising Covid-19 infections amid fears Beijing and other cities may soon be locked down. However, technically, another story is unfolding. There was a strong recovery that has taken out a micro trendline on the hourly chart as follows:

WTI H1 chart

The impulse was strong but a correction could be on the cards as per the following 15-minute chart:

WTI M15 chart

The price imbalances are in focus below and above key structures.

WTI M5 chart

The 5-minute chart is showing the price range bound for the time being but a break of $80.40/50 could be key for the day ahead. If bears take control, however, then 76.00 could be vulnerable if $78.50 gives as the 38.2% ratio support.