Back

25 Oct 2022

Crude Oil Futures: Further consolidation appears likely

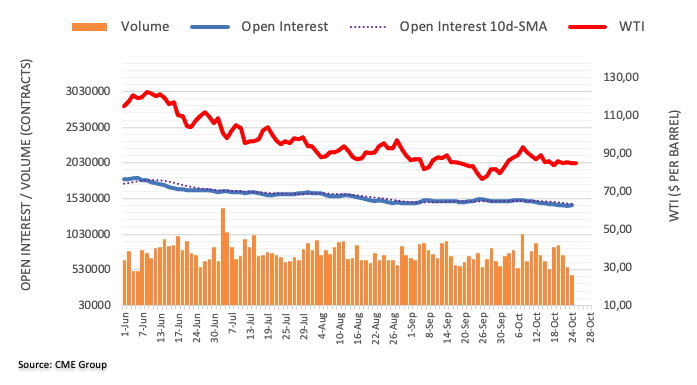

CME Group’s flash data for crude oil futures markets noted traders added more than 2K contracts to their open interest positions at the beginning of the week, partially reversing the previous day’s drop. Volume, on the other hand, shrank for the third consecutive session, now by nearly 107K contracts.

WTI: A drop to $80.00 is not ruled out

Monday’s lack of direction in prices of the WTI was on the back of increasing open interest and declining volume, which supports the view that extra range bound seems the most likely scenario for the time being. The breakdown of this theme could leave WTI vulnerable to a test of the key $80.00 mark per barrel.