Back

21 Oct 2022

Gold Futures: Further decline still on the cards

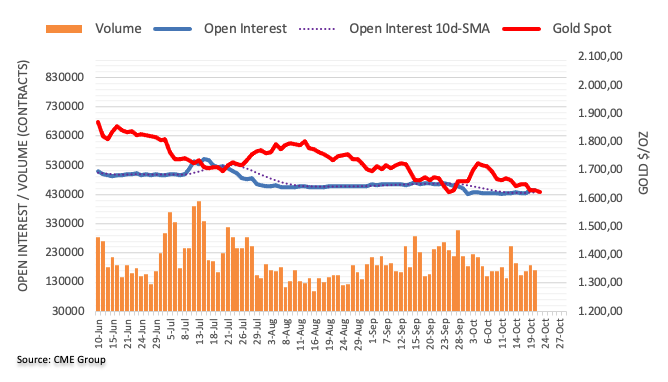

CME Group’s flash data for gold futures markets noted traders added just 893 contracts to their open interest positions on Thursday, reaching the third consecutive daily build. Volume, instead, reversed two daily advances in a row and shrank by more than 16K contracts.

Gold keeps targeting $1,614

Thursday’s inconclusive price action in gold was amidst a small uptick in open interest, hinting at the likelihood that further losses could be in store in the very near term. That said, the next target of note for the precious metal remains at the 2022 low at $1,614 (September 28).