Back

20 Oct 2022

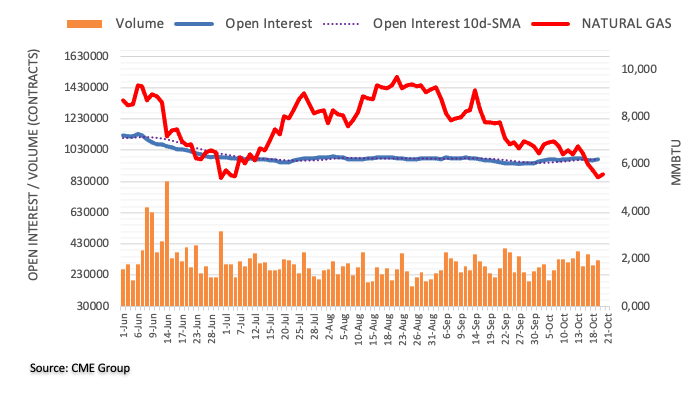

Natural Gas Futures: Rising bets for extra decline

Considering advanced prints from CME Group for natural gas futures markets, traders added around 7.5K contracts to their open interest positions on Wednesday, reversing at the same time three consecutive daily pullbacks. Volume followed suit and increased by around 35.6K contracts, keeping the choppy activity well and sound for yet another session.

Natural Gas: Next on the downside comes $5.00

Further decline in prices of the natural gas appear on the horizon following Wednesday’s daily retracement amidst increasing open interest and volume. Against that, the loss of the $5.00 mark per MMBtu should trigger further losses in the very near term.