Crude Oil Futures: Further rebound not favoured

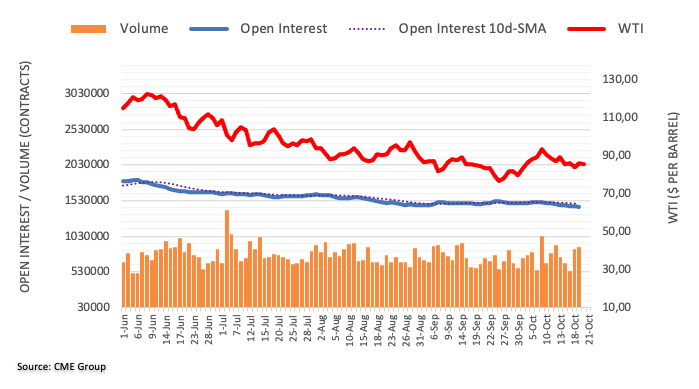

CME Group’s flash data for crude oil futures markets note open interest extended the downtrend on Wednesday, now by nearly 18K contracts. Volume, instead, went up for the second straight session, this time by around 30.2K contracts.

WTI: A drop to $80.00 remains on the table

Wednesday’s decent advance in prices of the WTI was on the back of shrinking open interest and hints at the view that extra gains look unlikely in the very near term. That said, another visit to the $80.00 mark per barrel still appears on the cards for the time being.