Back

19 Oct 2022

Natural Gas Futures: Downside looks overdone

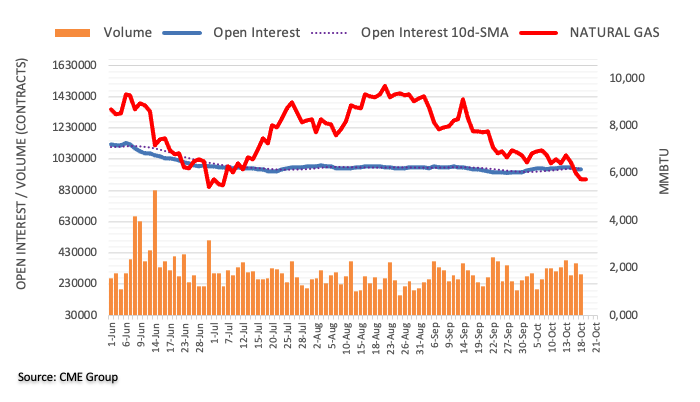

Open interest in natural gas futures markets shrank by 822 contracts on Tuesday, reaching the third consecutive daily drop, as per advanced prints from CME Group. Volume extended the choppy activity and went down by around 73.1K contracts, partially reversing the previous day’s build.

Natural Gas: Next support comes at $5.30

Prices of natural gas extended the recent breach of the $6.00 mark on Tuesday, dropping for the third session in row. The downtick was on the back of shrinking open interest and volume and is supportive of a near term rebound. In the meantime, the next contention area for the commodity emerges at the July low at $5.325 per MMBtu (July 5).