Back

12 Oct 2022

Crude Oil Futures: Door open to further losses

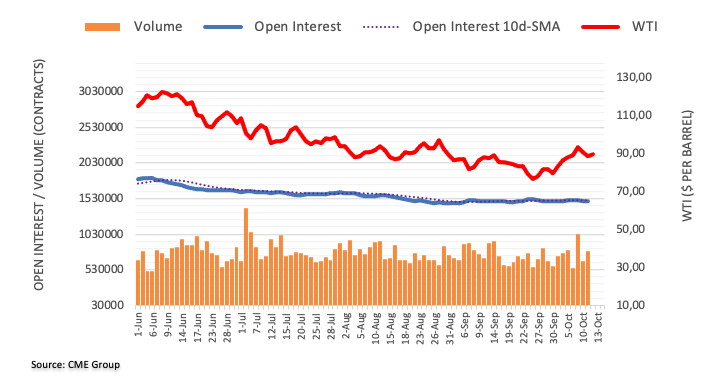

Considering advanced prints from CME Group for crude oil futures markets, traders added around 4.5K contracts to their open interest positions on Tuesday, reversing at the same time two daily pullbacks in a row. Volume followed suit and went up by around 141.5K contracts, partially trimming the previous day’s drop.

WTI: Upside remains limited by recent tops beyond $93.00

Tuesday’s retracement in prices of the WTI was on the back of rising open interest and volume, leaving the prospect for a deeper pullback well on the cards in the very near term. In the meantime, the October tops past the $93.00 mark per barrel continue to cap occasional bullish attempts for the time being.